This includes parking fees, laundry machines, vending machines, or other service fees associated with renting the units.

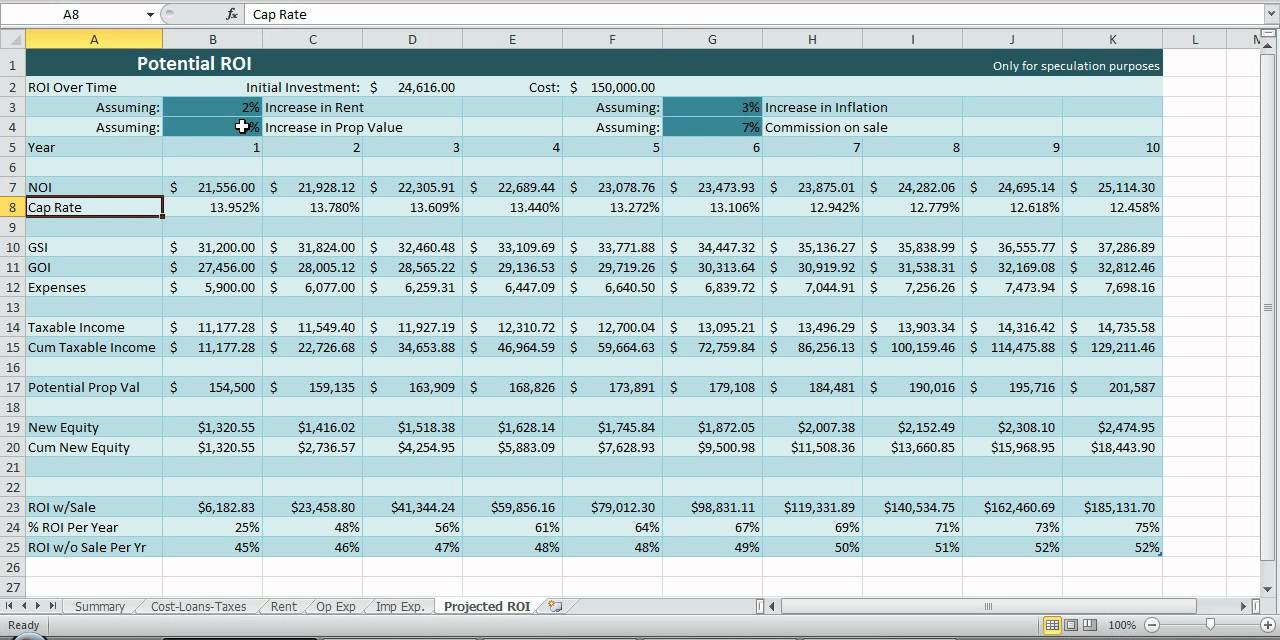

NOI = Income Generated from Property – Operating Expenses The Net Operating Income formula is as follows: Rents must be estimated accurately for the NOI to indicate the property’s profitability correctly.The NOI value depends highly on whether the property is being managed well.Lenders can use the NOI to see if a commercial property will be a good investment.The real estate NOI value provides an excellent high-level insight into what investors can expect in terms of ongoing revenue.Here are a few pros and cons of using the NOI. The flip side to that, however, is that because you’re not including the cost of financing the property, you will need to look at other metrics to get a complete picture. The NOI is a valuable number because it’s unaffected by how you finance a real estate property, which allows for a more objective comparison. For this reason, the NOI is not just used by investors but also by lenders to evaluate whether investors will have enough cash flow to make loan payments. It’s a high-level number primarily used to judge whether an income-generating property can provide positive cash flow. The Net Operating Income tells investors how much money they’ll make annually from a commercial or residential rental property investment. Let’s delve deeper into how the Net Operating Income is calculated and when it’s most valuable.

More specifically, NOI is used to determine the total revenue and profitability of the property after all operating expenses have been deducted. Net Operating Income, or NOI, is a calculation used to determine the profitability of an investment property. Several metrics allow real estate investors to calculate the profitability of a commercial real estate investment, none more critical than the Net Operating Income. As a real estate investor, it’s important to know whether the investment property you’re purchasing is profitable, and if so, by what measure.

0 kommentar(er)

0 kommentar(er)